It is tempting to believe that the more comps we have the better. That’s not usually true and, in practice, can lead to some unfortunate judgments.

We really have to get GOOD comps and if we try to have the best, we will more than likely have fewer rather than more. Here are a few examples from some actual cases.

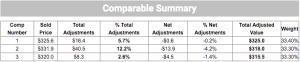

This first table shows a typical set of three comps:

These have a range of $315,000 to $325,000 and a reasonable spread of Percent Total Adjustments. Assuming we have checked the adjustments, we could probably accept these and not do much more with them unless we wanted to weight them.

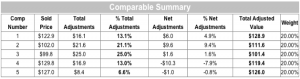

This next set is a little different:

It has five comps that average about $117,000. These all looked good on paper and in MLS, but when we look at the Percent Total Adjustments we see that comps 2 & 3 are higher than the others and are well outside the recommended range of 10 points between the lowest and the highest Percent Total Adjustments. As it happens, they also adjust to a lower Total Adjusted Value than our other comps.

Because of the high Percent Total Adjustments and the questions raised by theTotal Adjusted Vales, we can eliminate comps 2 & 3. The average of the remaining three is $127,000, which is a significant difference from the average of the five together.

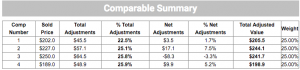

Finally, we have this group of four, which averages about $223,000:

The Percent Total Adjustments are all in very close alignment so we could assume that these are all good comps and that we have a pretty solid analysis…but that would be a big mistake.

Looking at the Total Adjusted Value column, we really have two sets of comps; two comps are in the low $240’s and two are in the $200,000 range. Two of these comps need to go, but which two? Only the agent will be able to tell and he may have to do some work to find out…drive by them, maybe call the agents who were involved in the sale…but clearly these comps do not belong together. They are even out of each others’ price range.

And ending up with two comps is not a bad thing. Two are going to be clearly better than four in this case.

Choosing a large number of comps is tempting, but we really need to be able to evaluate the suitability of the comps that we are using. If we don’t, then we are often left with the wrong value and no way to know for sure that we could be making a mistake. It is a big reason why agents sometimes lack confidence in their CMA.

The Percent Total Adjustments method used by appraisers is one of the more common evaluation methods, with the lowest Percent Total Adjustment being the best comp, at least mathematically. Our recommendation though is that this should be a guideline and not a rule…that the lowest Percent Total Adjustment by itself is not enough to get a good handle on the right comps.

We should always be looking at the Total Adjusted Values as well. If they do not make sense, then we should either be able to explain why or get rid of the comp or comps that do not fit.

More is not very likely to be better.